INSIGHTS:

Stay Informed and Inspired

Explore the Latest News, Articles, Case Studies, and Whitepapers from Industry Experts

Your Source for Industry Knowledge

Welcome to UASI's Insights! This is your go-to destination for the latest articles, whitepapers, and thought leadership pieces in in mid Revenue Cycle. Our Insights Center is designed to keep you informed and inspired with expert analysis, innovative ideas, and helping to build your knowledge on a variety of topics. Whether you're looking to stay ahead of industry trends, gain new perspectives, or find solutions to complex challenges, our curated content has you covered. Dive in and explore a wealth of resources that will help you navigate and excel in the ever-changing healthcare landscape.

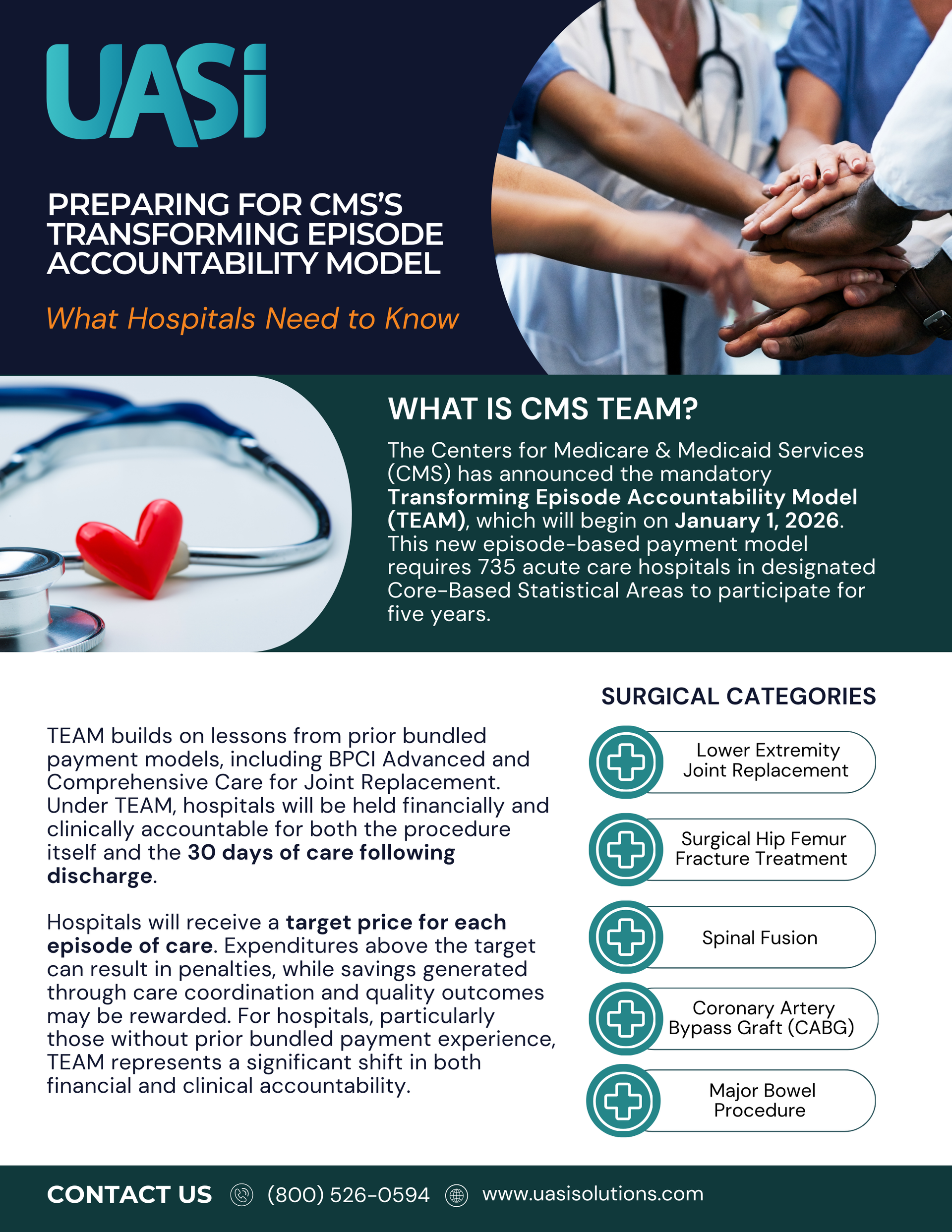

Preparing for CMS’s Transforming Episode Accountability Model (TEAM): What Hospitals Need to Know

Starting January 1, 2026, the Centers for Medicare & Medicaid Services (CMS) will launch the mandatory Transforming Episode Accountability Model (TEAM). Covering five high-cost procedures, TEAM makes hospitals responsible for both the surgery and 30 days of follow-up care. The model brings new risks and opportunities, making early preparation critical for success.

Meet the Mavericks!

Welcome to UASI's Top Gun Spotlight! Here, we shine a light on the brightest minds and leaders in the healthcare industry. Our Top Gun series features in-depth interviews, inspiring stories, and expert insights from the professionals who are making a significant impact. Get to know the trailblazers driving innovation, setting new standards, and shaping the future of healthcare. Whether you're seeking inspiration, mentorship, or a fresh perspective, our Top Gun Spotlight offers valuable lessons and powerful stories from those at the top of their game. Join us and be inspired by the leaders who are transforming the industry!

Featured Article

Is Your Risk Adjustment Program Contributing to Burnout?

Burnout in healthcare is a significant and growing issue, affecting everyone from frontline clinical staff to administrative personnel.

Despite ongoing efforts to tackle this challenge, burnout remains alarmingly high among physicians. According to the 2024 Medscape Physician Burnout & Depression Report, 49% of physicians are experiencing burnout, a modest improvement from the previous year’s 53%. This underscores the lingering impact of COVID-19 and the heightened pressures within the healthcare system.

Healthcare practices are juggling Fee-For-Service (FFS) and Value-Based Care (VBC) models simultaneously. This means that there is either one generalized process that effectively serves both models or two distinct processes, rules, tools, and approaches. The FFS model pushes providers to see more patients and perform more procedures, which can be overwhelming and lead to unnecessary services. On the other hand, VBC emphasizes quality care and chronic disease management over the long term, requiring various management methods beyond traditional encounters. Balancing these models and meeting compliance demands can be daunting and contribute to burnout.

Top 5 Strategies You Can Implement Now to Reduce Burnout

1. Simplify Administrative Tasks: Reducing bureaucratic tasks like charting and paperwork by employing Clinical Documentation Integrity (CDI) and coding professionals allows providers to focus more on patient care and less on administrative duties. Organizations that utilize CDI professionals reduce denials, re-work, and improve the effectiveness of their queries. This reduces the administrative burden not only for physicians but also for CDI and coding professionals.

2. Proactive Scheduling of Patients: Prioritizing Annual Wellness Visits (AWVs) and transitional care visits using Risk Adjustment Factor (RAF) scores, or Hierarchical Condition Categories (HCCs) helps manage resources efficiently and reduces provider burnout. Using data to understand current RAF scores and recapture opportunities by patient ensures that the patients with the most impact are seen at least annually and given their chronic conditions, more frequently as appropriate.

3. Conduct Prospective CDI Reviews: Ensuring CDI professionals prospectively review records and communicate priority clinical indicators guarantees accurate medical documentation, reduces the time providers spend researching patient records in advance, and ensures optimal outcomes while reducing re-work.

4. Effective Use of Coders: Utilizing professional coders to handle diagnosis codes for claims reduces compliance issues, lost revenue due to over-coding or under-coding, and increased frustration. A streamlined coding process ensures that claims are processed expeditiously, resulting in faster cash flow. This not only saves time but also reduces compliance risks and the administrative burden on physicians.

5. Leverage Technology: Implementing advanced technology solutions, such as our proprietary software RAF Vue™️, can significantly enhance efficiency and accuracy. Instant insights into chronic code capture and recapture opportunities allow for quick identification of patients with the greatest treatment and financial impacts. With a centralized, patient-level view and automatic calculation of reported and potential RAF scores, RAF Vue™️ generates comprehensive reporting at the patient, provider, and reviewer levels. Best of all, RAF Vue™️ can achieve immediate go-live without requiring EMR integration, reducing the technological burden on your practice.

Comprehensive Support from UASI

At UASI, we specialize in guiding healthcare organizations through the intricacies of risk adjustment and value-based care. We evaluate programs, assess needs, identify priorities, and create effective strategies to reduce administrative burdens, enhance care quality, and improve financial outcomes. Our goal is to support your practice in reducing burnout and improving patient care.

We are here to help.

Let us help you navigate the complexities of risk adjustment and value-based care to achieve sustainable success. Contact us today to learn how we can support your practice in reducing burnout and improving patient care.