Medical Coding Examples & Tips for Everyday Coding Success

Explore concise, expert-driven medical billing and coding examples that

breaks down complex scenarios into

clear, usable insight.

Just released: The 2026 HCC Passport

Updated for 2026, this practical resource supports coders and healthcare leaders with defensible HCC documentation and coding guidance to improve compliance, reduce risk, and impact RAF outcomes.

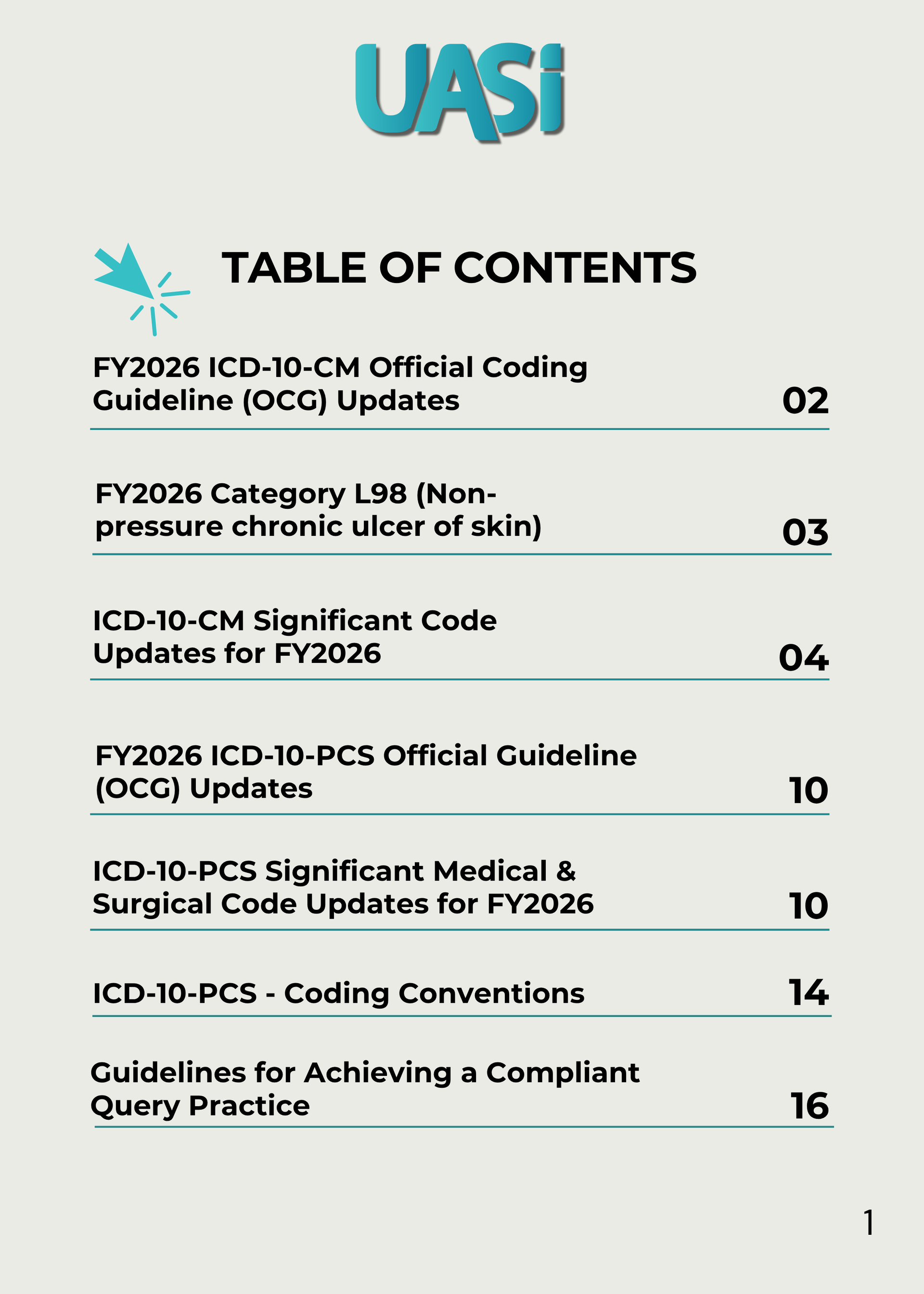

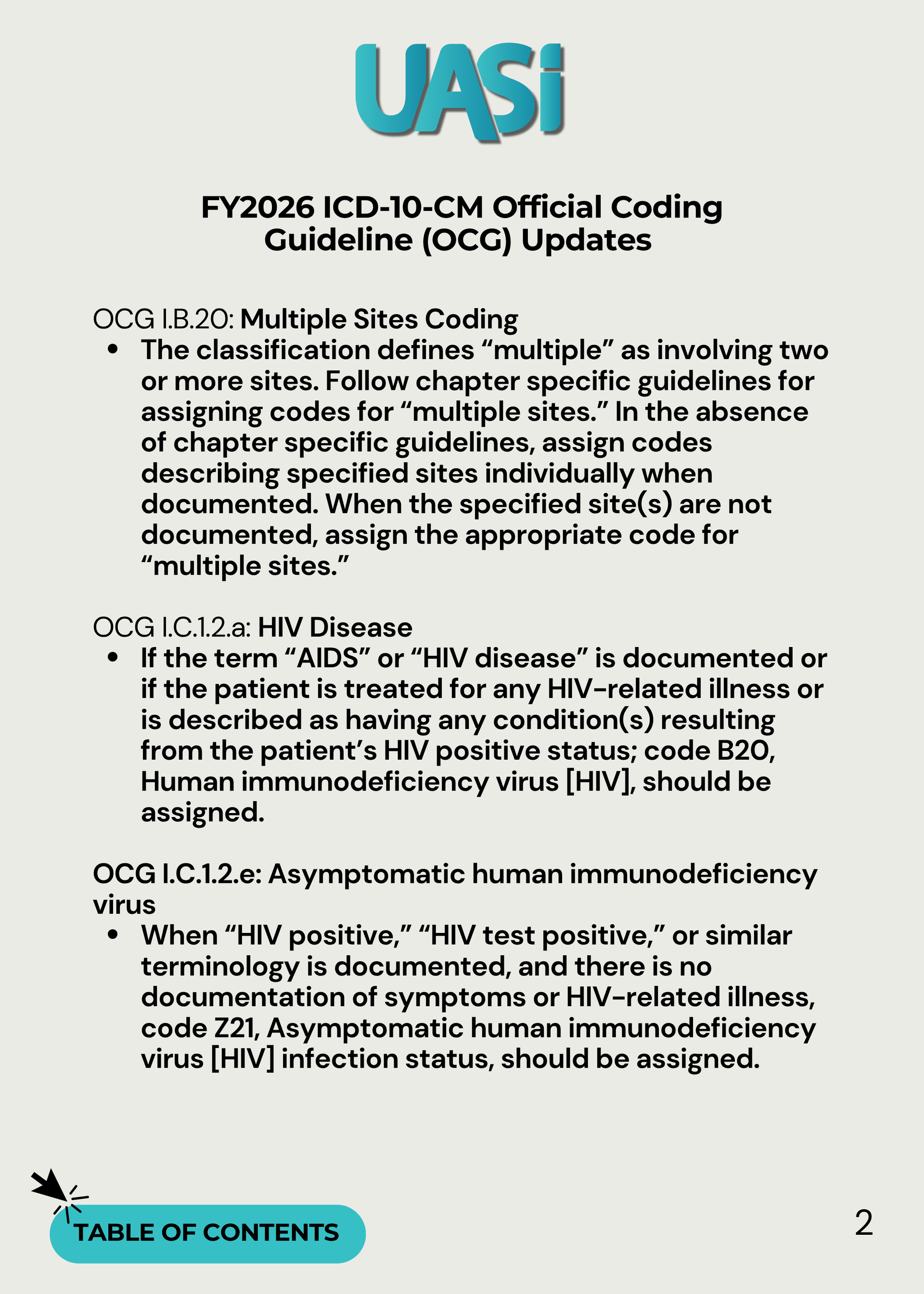

2026 ICD-10 Coding Tip Guidebook Now Available!

Stay Current and Enhance Accuracy with UASI’s Professional Guidance

Get instant access!

Coding Tips

Welcome to UASI's Coding Corner! We're here to make your medical coding journey smoother and more enjoyable with our friendly and practical tips. Whether you're just starting out or you've been in the field for years, you'll find something useful here. Our expert advice, handy tricks, and up-to-date industry insights are all geared towards helping you code more accurately and efficiently. So, grab a cup of coffee, get comfy, and explore our tips to take your coding skills to the next level!

Stay ahead with UASI's

Monthly Coding Tips

Featuring practical advice, industry updates, and best practices to enhance your coding accuracy and efficiency. Sign up below to receive monthly coding tips directly to your inbox!